Some businesses just come with risk. While you do your best to maintain a safe environment for everyone involved, there’s no way to eliminate the risks altogether. Once you’ve done your due diligence, it's time for you to take steps to protect your business, and that protection typically comes in the form of a release of liability form. These documents can provide additional protection from incidents whether employees or customers are involved. However, administering these kinds of documents physically is simply outdated and can lead to unnecessary headaches. That's why it's time to get on board with the digital revolution and bring your legal documents online

Get Your Liability Release Form Set Up Today ›

These are just some of the common questions that we are asked about our products and services, and how we can help your organization. The information and materials on this website, including the questions and answers, are not intended to be, nor should they be interpreted as, legal advice or opinion.

Whether you’re using a paper release of liability form or considering converting your paper release form to an online version, there are many important decisions to keep in mind. Here are some of the most commonly asked questions by our WaiverSign customers and those looking at our services. You may find some helpful information here, but you should always have a lawyer who specializes in liability forms and waivers review your documents and processes associated with them.

Liability waiver templates are just about everywhere you look online and may give you a good idea for your forms, but this doesn't replace the assistance of legal professionals. When looking at these templates, it's important to consider the age of the template. Changes may have been made regarding legalities within a given jurisdiction. You have to make sure that the template is also suited to your industry. The last thing you want is to have people sign a liability form only to provide zero protection for your business under a legal document. Truthfully, discrepancies will be present no matter where you look if you’re trying to use a template.

A release of liability waiver can be useful for several reasons. One of the primary reasons businesses turn to these forms is to protect themselves and their employees from liability. The form is called a release because participants who sign it are releasing your company from liability for injury and damage they may encounter during the covered activities.

A well-crafted and signed release of liability form can help protect your company against a negligence claim from one of your customers in certain jurisdictions if upheld by the court. Negligence is the failure to use reasonable care that results in injury or damage to a person to whom you owe a duty of care. If your company is sued or threatened with legal action by a customer who signed a signed an electronic iability waiver, you can use that legal document to assert a contractual defense to liability. In other words, the customer signed a contract knowing the risk and agreed not to hold your business liable for injuries or other damages. Think of it as another layer of protection against liability for you, your business, and your workers.

A release of liability waiver educates potential participants about what risks they might face as part of the covered activities, and, if applicable, what kind of skills they need to operate within a given environment. These signers can use that information to decide whether the activities are right for them or they should opt for another job or experience. Many will decide to go forward, knowing what is involved. However, a few people will see it as an alert to consider other options.

Any adult should sign their own release of liability waiver. The parent or legal guardian of any minor participant should sign for the child. Courts are more likely to enforce a waiver form that was signed by the adult caring for the minor rather than another on the parent’s behalf, like the coach of a team.

This all depends on the jurisdiction. Courts are more likely to uphold liability agreements that are well-drafted to meet requirements based on local, county, state, and federal laws. The language must also be laid out as clearly as possible to better the chance of a releasor (the party requiring a signature) to avoid having to offer a payout to a releasee (the person signing the waiver).

Courts will also look at:

If a release of liability document is standalone, rather than part of one huge contract, courts see that as a demonstration of care and concern on the part of the company requiring a signature. Avoiding fine print also helps avoid any inaccurate information from slipping through the cracks. With the right language, courts will view your liability waivers as achieving the legal protection needed to prevent you from losing a legal ruling

WaiverSign strongly recommends that you consult with an attorney familiar with your state laws, business type, and the drafting of liability waivers. You can also check with your local bar association. If you need some recommendations, let us know. We can share some contacts of attorneys who have worked with other WaiverSign clients.

Changing from having your release of liability signed on paper to an online version is no small change. It does require some formatting changes and the ability to make sure that the releasee can sign online. That said, there is a tremendous amount of benefit to having participants sign online. When you decide to switch to WaiverSign, we’ll convert your paper waiver into a digital format for you - it’s all included in our digital waiver pricing.

Electronic signatures, also known as e-signatures or eSign, are a technology that has evolved in recent years and is recognized as a legal signature in the United States. Other countries are also following suit, finding e-signatures to be just as valid as paper and ink.

Read more about electronic signatures on waivers and laws that make this possible

At the end of the day, the bottom line means everything to your business. That's why it's important to consider how much documentation you rely on before making the switch from paper to online. You should take into consideration the number of releases that you need to be signed, the way in which they are presented, and how the releases are then collected and organized. The method of storage actually can end up being more of an expense than the forms themselves. An online release of liability form often saves you money on both printing and storage, while also sparing you from other issues with legal documents.

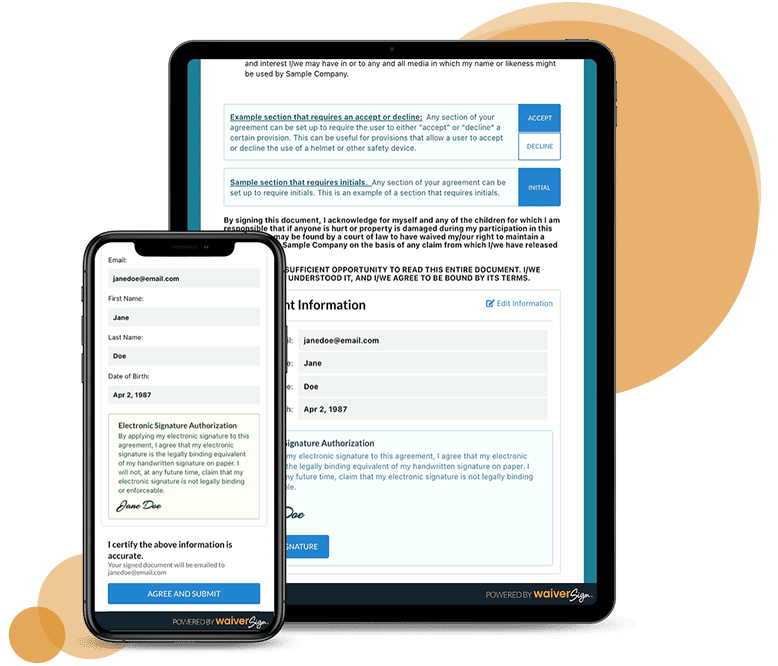

Although people often breeze through various online terms and conditions, WaiverSign has created a process that ensures the entire liability waiver or agreement is viewed by a potential releasee before they apply their electronic signature. WaiverSign also sends an email of the signed document to the email address of whoever signs a document, so that they are given the opportunity to review the documents at their own convenience.

The statute stated that a “signature, contract, or other record relating to such transaction may not be denied legal effect, validity, or enforceability solely because it is in electronic form; and a contract relating to such transaction may not be denied legal effect, validity, or enforceability solely because an electronic signature or electronic record was used in its formation.15 U.S.C. § 7001 (a) (1) & (2)

An e-signature is defined by this same statute as an electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record” was also addressed. 15 U.S.C. § 7006 (5)

That means whether you have a signer's John Hancock, a swiper of their finger, or simply a box checked off online, you have confirmation that the signee has agreed to accept the terms of the waiver in full. The client is, in effect, signing a binding contract. Whether you're having a tenant sign a new lease for their apartment or transferring a vehicle record over for DMV purposes, this is considered sufficient enough to meet legal standards.

From banking to real estate transactions, more and more industries rely on, and indeed prefer, the electronic approach to serving up documents, and receiving signatures. That said, we recommend that you confirm with your own insurance carrier that they accept electronic liability waiver forms with electronic signatures.

As with paper liability forms, there is no guarantee that each individual signed their own release of liability. However, the WaiverSign process provides many features not available with paper documents. WaiverSign records the signer’s IP address, along with a timestamp confirming when the liability form was signed. This information is a feature of the document’s audit trail, allowing for an accurate source to confirm the signing took place and with an understanding of the legal document. WaiverSign also requests information from each person who submits a signature, including name, address, date of birth, email address, and other unique identifiers based on circumstances.

Much of this information is checked for accuracy and completeness when it’s entered in the online form. With paper forms, signers can simply have anybody sign for them. The steps taken by WaiverSign are more robust than when someone simply turns in a paper waiver form that could have been signed by someone else. Assess the current process by which you handle paper waivers. This will let you know the best steps to take to cover your bases legally while making sure that the documents are being signed by the appropriate parties. As a releasor, it's important to have knowledge of the releasee signing or that of third-party vendors whose signatures may be required. The goal is to avoid any loose ends that can leave your business susceptible to a negligence lawsuit.

WaiverSign takes the privacy and security of its customers’ information very seriously. Our protocols adhere to national and international security standards that are designed to protect customer data. In the event of any data breach, WaiverSign will respond quickly and promptly notify customers that their information may be at risk.

While there are statutes in place at the federal level to identify online signatures, there is still some deviation in legislation when it comes to lower levels. Each state or province may have different laws regarding the use and process for using online forms. This is something to discuss with a licensed legal professional to make sure that the use of this site will help avoid any discrepancies regarding a waiver form.

Legal opinions on this may vary, so be sure to check with your legal counsel about your particular service. Oftentimes, the thought is that providing the link in advance gives signees ample time to understand the risks prior to any time they may invest in traveling to your location or the possibility that they may be rushed in filling out documents.

Easy access to your website and any important documents is important to make business processes easier for you and those using your services. It starts with building a page on your website, introducing your online waiver on the page, and adding a button that links to that form. You’ll find the link creator under WaiverSign > Get Signing Link. If that sounds complicated, WaiverSign’s web team will be happy to help you every step of the way.

Just visit WaiverSign > Get Signing Link. You’ll simply copy the link and paste it into the body of the email that you’re sending. It’s a great idea to include the signing link in a confirmation or receipt email.

Setting up a kiosk does require some additional hardware like a tablet and an adjoining kiosk enclosure to protect that tablet. Once you have that, you’re ready to install the kiosk application and set the “homepage” of the kiosk to your release of liability waiver-signing process. WaiverSign has a special “kiosk mode” that you can select when grabbing the link to your document(s) at WaiverSign > Get Signing Link.

This kiosk mode will actually cause a countdown to appear on the screen when there hasn’t been any activity for a while. If the countdown runs out and the user does not request more time, the kiosk will reset to the start screen so that the next person who approaches the kiosk is not confused as to where to start.

WaiverSign makes it incredibly easy for participants to only fill out their information once and then sign as many documents as needed, using that same information. Many businesses will present more than one document such as a 'hold harmless agreement', followed by a photographic consent form, followed by a rental agreement. This division of documents allows the release of liability form to not get diluted with the wording of the other documents that also require online signatures.

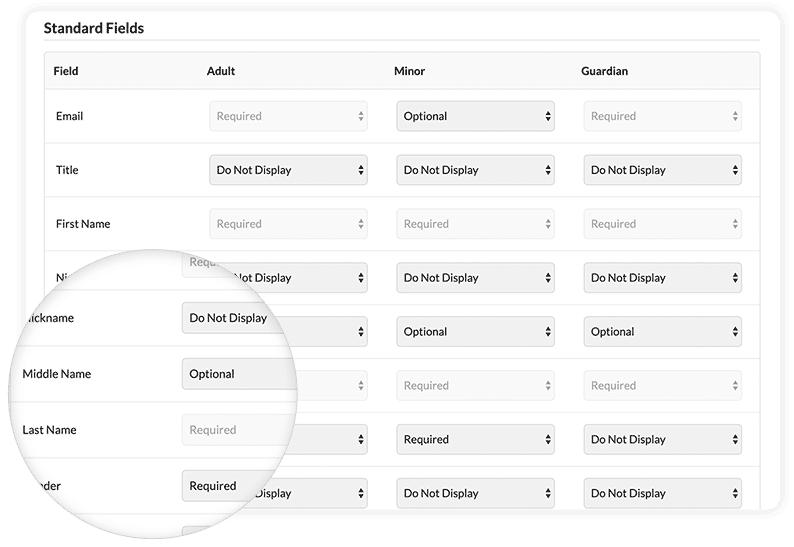

In addition to sixteen optional standard fields, WaiverSign also provides the ability to add an unlimited number of custom fields to an online form. You can select from a general text field or text area, a drop-down list with a single selection, or a checkbox list with multiple selections.

Yes. Whatever you enter in WaiverSign is your content and you are ultimately responsible for any updates or edits to that content as time goes by or documents are revised.

Thanks to the covid pandemic, QR codes are back and most everyone understands how to use them. They’re a great way to get people to sign your release form on their own mobile devices. To get a QR code, simply take your singing link and paste it into a QR code generator. You can then download the QR code for use on signage at the front of your queue, stickers at the front desk, or other locations that make sense to have people sign their release forms.

WaiverSign does provide a checkbox for releasees to specify whether they wish to receive or not receive communication by email from your business. Each person who signs an online release of liability or similar document will appear under 'contacts' inside the application. These contacts can be exported and used for marketing or other internal purposes. However, you must not send marketing emails to those who have opted out. If you do, you run the risk of being flagged as spam which will make it harder for you to deliver emails to those who actually want to receive emails from you.

WaiverSign allows you to export lists for all your contacts as well as those who have signed during a specific date range or for a specific event that's coming up. This will allow you to send off program information or other details to people that want to be in the know.

Legally, you may need to offer the ability to sign on paper even though you offer a service to sign online. Make sure the wording in your paper waiver is the same as your online waiver. It doesn't hurt to keep physical copies on hand just in case. However, a PDF copy of the document is also sufficient to send via email. We suggest discussing this topic with your attorney.

WaiverSign provides integration capabilities for third-party systems that allow participant data to automatically sync. If this type of integration is not available with your current system, you can simply use WaiverSign as the primary storage location for this data. With proper machine translation through WaiverSign, you can even directly generate email lists and other reports.

In WaiverSign, you can create groups of signed waivers by creating an event. An event can be as simple as a name or it can contain a date and time. If you operate an intramural sports league, you can have files assigned by the team or the location of the home field. You'll want to have a system in place for a simple query based on particular determinations. You can easily set up these individual events inside WaiverSign and then create a link to sign your liability form that also associates the specific event to that signature. Alternatively, you can let those releasees select the event in which they are participating and select the form they need.

WaiverSign currently offers English, Spanish and French versions of the signing process. If you need to present your liability waiver in another language, let us know and we can build an additional language bundle to support that language. Keep in mind that you will be responsible for the actual translation of the waiver form or other documents into any language.

The electronic signature process of WaiverSign ensures that each participant fills in information for every required field. Formats for phone numbers, email addresses, dates of birth, and others are validated to ensure proper formatting and completeness. A release of liability form or agreement cannot be submitted until these required fields are properly filled in.

WaiverSign makes it easy to look up those signing up by name or an entire group at once by using a group ID number to ensure signed liability waivers have been submitted. WaiverSign also provides integration for third-party systems such as Resmark Online Booking System, which allows you to easily see the e-sign status of all parties involved. If any participants are missing, WaiverSign can be used to collect the signed liability forms for these individuals.

Use WaiverSign’s online liabiltiy release form software to quickly and easily create and administer your release form. Getting your release up and running is as simple as 1-2-3!

Our WaiverSign team will convert your current release to an online version.

Add your new online Release of Liability Form link to your website, emails, or kiosk.

Signed agreements are securely stored in WaiverSign and retrievable in seconds.

Includes 50 free Release of Liability Form signings per calendar month. Additional signings are only 12 cents each.

Get a Free Trial ›

Paper documents are a hassle, both for releasor and releasee. Using paper, there need to be witnesses and fresh copies of the documents on hand. Then, all of those copies have to be collected, which sounds easy, but they are highly susceptible to being damaged or getting lost. Any information that’s collected stays on the paper unless it’s entered into a computer. Those physical signed copies also have to be stored, which is another expense for a company. Digital documents change all of that. Share them with a simple link, let them sign in a few clicks, and sit back as they're stored securely and safely in a virtual environment.

Free Trial

Building a document in WaiverSign is easy, and modifying that document afterward is pretty simple to do. Input all of the text then set the input fields for participants to complete. You can choose from a variety of presets, or create your own custom questions, and collect whatever information you need. Then, information on signed releases is stored in the database, making for easy reference when it comes to the purposes of information. You also avoid having to reprint new documents and wasting paper and ink with every revision.

Get Started

WaiverSign makes it easy to present your brand in a professional way, adjusting formatting and looking to bring a unique edge to your release of liability waiver. This can be something as simple as adding your logo to your forms or customizing the color palette to match your style guide. With just a few clicks, your forms can be differentiated, even adjusted for various scenarios.

Set Up Your Release Form

Digital signing is just easier. You send a link in advance and just wait on the response, whether it's moments after sending an email off with the contact information a customer has provided, or waiting a little bit. With the establishment of kiosks, you're also adding another way of completing this task. This has been a tremendous asset in recent years with an emphasis on social distancing, allowing for accomplished goals and a friction-free signing experience.

Free Trial

WaiverSign makes it easy for parents or legal guardians to sign a waiver form for their child. The same link that allows adults to sign for themselves will allow them to sign for minors as well. Plus, you can customize who can sign and what the “age of majority” is, varying based on circumstances.

Free Trial

WaiverSign enables you to build your digital document to meet your business needs.

WaiverSign can help you collect electronic signatures on just about any agreement that you need to have signed repeatedly. Your clients will love how easy it is, and you’ll love getting organized and saving time. This includes:

Whether you provide an experience, manage events, promote healthy lifestyles, or help with personal care, you’ll find WaiverSign’s online waivers and digital release forms will save you time and money. WaiverSign’s online waiver software makes managing waivers simple for:

"We use WaiverSign for our new Code of Conduct and Member Acknowledgement. It is so user friendly for our varied demographics and streamlines the process for our health club. We love how simple it is to use."

"WaiverSign has helped our check-in process, lightened my workload, and provided an easier format for our guests and for us. We love being able to associate guests to an event name and easily look up guests."

"Working with WaiverSign has been a great experience. Having WaiverSign on our website allows large groups to complete the waiver prior to arriving, thus speeding their entry into our locations."

"WaiverSign was able to help us get our system up and running quickly and seamlessly. I highly recommend them for anyone looking to collect and organize waivers from a large group of participants."